Award-winning PDF software

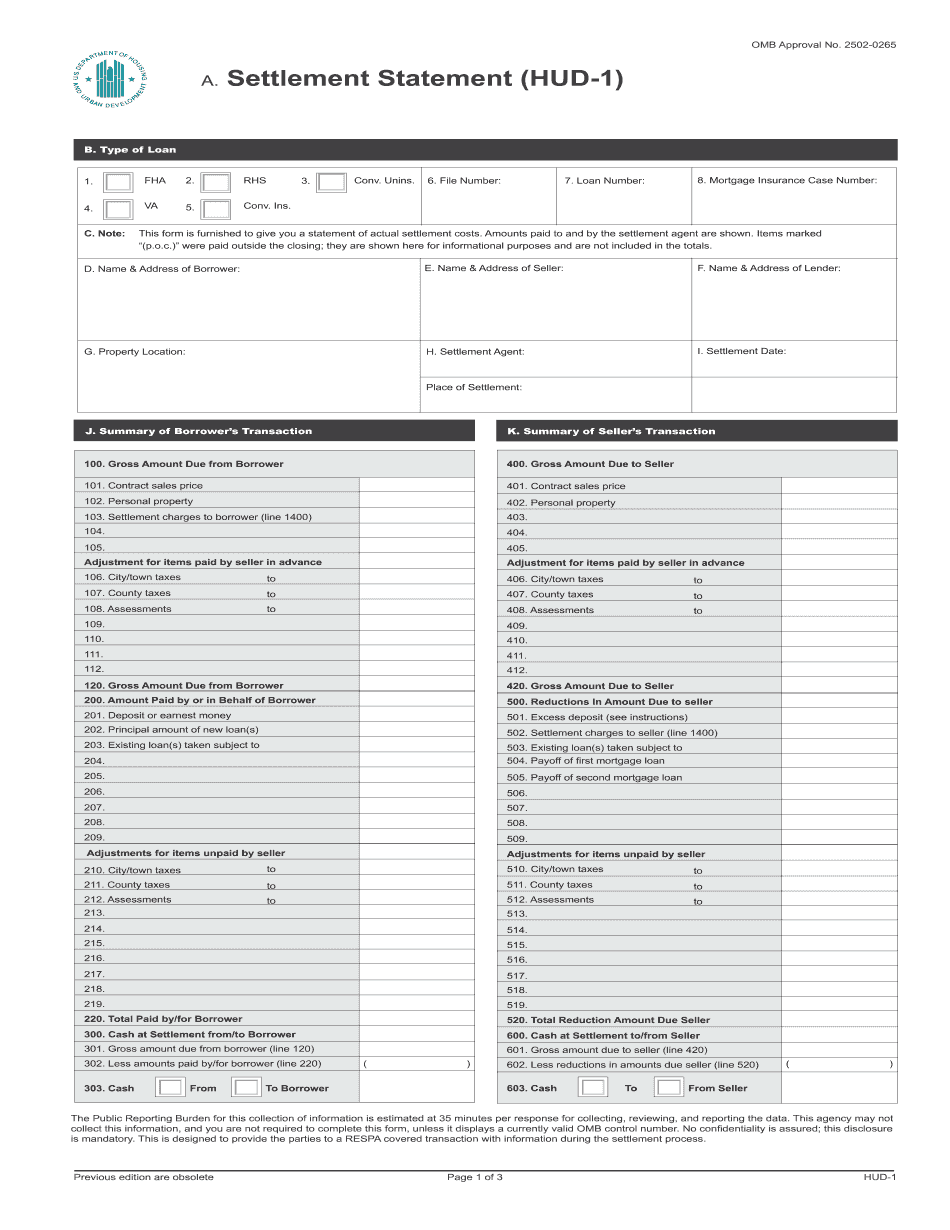

HUD-1 Form: What You Should Know

A HUD-1 Form Definition — Investopedia A HUD document is defined as a legal agreement between parties, which typically defines obligations, payments, and the terms of repayment. Here's a HUD-1 settlement statement : Notice of Federal Housing Administration Settlement Agreement with BARRIER to Mortgage Broker-Dealers | PDF | Word In a foreclosure, the United States government can seize and sell a home that hasn't been paid on its mortgage, when it defaults. This occurs when the mortgage isn't paid by its due date. But if the mortgage on a home has been paid, it can't be foreclosed on even if the home no longer exists. In the mortgage business you're looking at mortgage-backed securities (MBS) The financial products of mortgage companies such as Fannie Mae, Freddie Mac, and the Federal Housing Administration. These were guaranteed by the U.S. government until the financial crisis. All the mortgages in the U.S. were insured by the Federal Housing Administration (FIFA, FH LDC), the insurance provider for first mortgages, second mortgages, and home equity loans (Helots) up to the value of the mortgage on the property. The FDIC and FIFA insured a subset of these loans -- the mortgage-backed securities. These investment products were used by the federal government to fund programs designed to stabilize the economy, such as Social Security and unemployment compensation. Most of these loans are now in default — and that's why these securities were sold to investors such as hedge funds and pension funds for a song. Here's the bottom line — if the mortgage on your home is paid in full you do not owe anything to the bank. The bank is allowed to foreclose only on the note, which is the deed to the property. All other payments for property taxes, insurance, property management, maintenance and property management fees, plus attorney fees for legal action, are not taxable to the owners of an MBS. The mortgage is not owned by the bank, and it cannot be liquidated through selling it. In the end it will not lose any value at foreclosure. Because the bank is the holder of the mortgage it owns the note, which has a legal guarantee from the FHA that pays out the mortgage on the note.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.