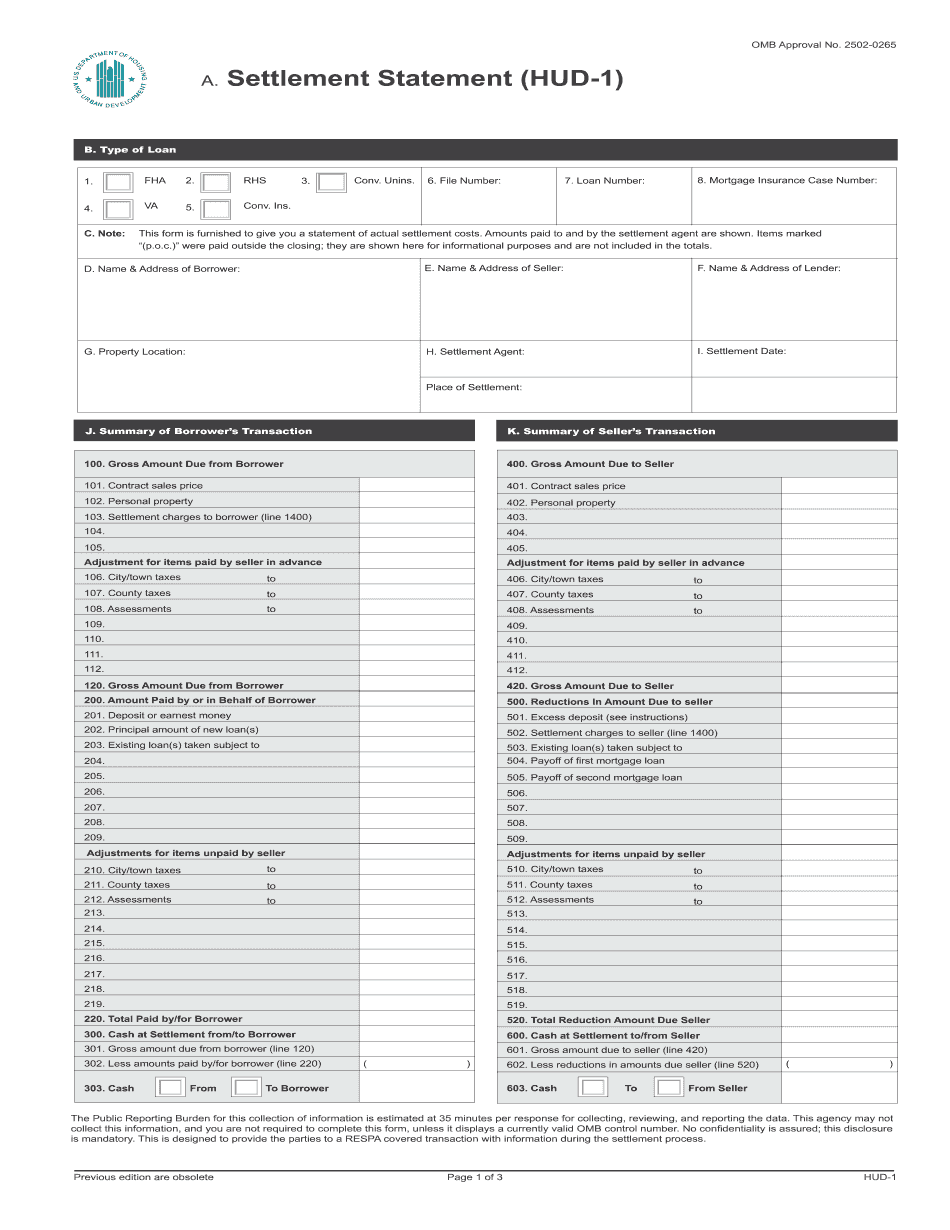

Hi everyone, Aneesa here with Fikriye. I wanted to go over closing disclosures and how to read them, specifically the HUD one form and the TILA replacement form. Here's a question that came in: "I bought my last investment property in 2013 and I'm pretty sure the HUD one form is gone now. What form is being used instead?" Since August 2015, both the previously used HUD one form and the Truth in Lending Act disclosure are no longer in use. They have been replaced by a streamlined closing disclosure that combines elements of both the former documents. This closing disclosure, in compliance with the law, should be delivered by the creditor to the buyer three days before the loan is scheduled to close. The numbers on this form should closely match the numbers on the loan. The closing disclosure is a form that must be given to the buyer three days after their loan application is received. The borrower is required to go through the closing disclosure and verify that there are no major changes between the loan terms and numbers. In the past, people would try to give the HUD one form and TILA forms as close to closing as possible, hoping that fewer people would read it and fewer mistakes would be found. Page 1 of the closing disclosure includes loan terms such as monthly payments, amount due, cash at closing, and escrow numbers. It also includes details about the loan amount, interest rate, monthly principal and interest, and any prepayment or balloon payment amounts. Page 2 lists the costs of all parties involved, including the borrower, sellers, and others. These costs are broken down line by line, including all fees, closing cost details, and loan costs. The three columns from left to right indicate whether the borrower,...

Award-winning PDF software

Hud-1 replacement Form: What You Should Know

Disclosure forms and related documents are available here. Please click on the link for the most current documents. The documents for the old version of the Form 4105 are here.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Hud-1 replacement