Award-winning PDF software

Hud-1 example Form: What You Should Know

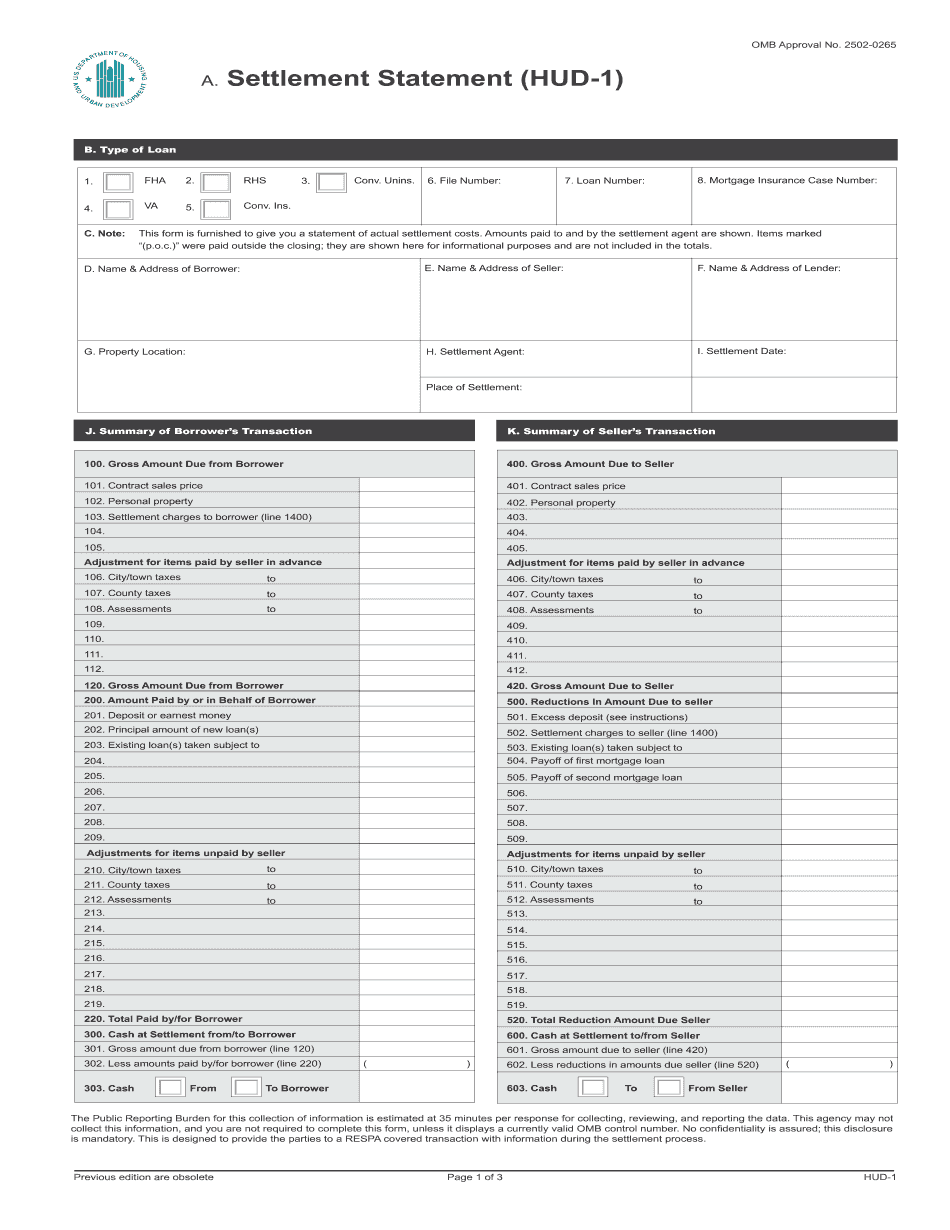

Amounts paid to and by the settlement agent are shown. Items marked. 2. This form is a Record of Impress Fund (RIF) settlement statement form. 3. This type of settlement statement is intended only for individuals that have paid off a mortgage. It is used as a settlement statement for mortgage payments that have been paid on a loan that has been modified, reduced, or no longer on the Federal Register list of mortgages being modified. This form should not be used as an alternative to a mortgage statement from a public mortgage company. Please call the Settlement Division at for assistance with this application. Do not use this form to verify an individual's employment status. C. Note: This form is furnished to give you a statement of actual settlement costs. Amounts paid to and by the settlement agent are shown. Items marked. Frequently Asked Question : Is this form for a real estate settlement? No. This form is for a HUD-1 settlement. Q : My home is being foreclosed, what forms should I use? A : Fill out the forms as directed on the forms or give the Department of Housing and Urban Development (HUD) a written description as to what form must be used. Do not use the form that HUD recommends but that you think the Department is using. It is important to note that a HUD-1 settlement cannot be used in a foreclosure proceeding. Q : What if I'm not satisfied with the statement that HUD-1 gives me? A : Write, fax, or email a complaint to The National Inquirer Housing Reporter. Q : What are the requirements listed below that I may not use in settlement negotiations? A : HUD-1 Settlement Statement Forms are for the Statement for a mortgage modification application ONLY. We only allow a single mortgage modification form per application (e.g., a credit union or FHA). If all applications are on the same form, the form must contain the information listed below. You must have: A signed contract of sale. A contract for a new home, not mortgage-related to the modification. Proof of the purchase price of the house (with a purchase price tax certificate). Proof of the closing date, or closing agreement (both completed if the sale is final). (2) The home in question must have sufficient interior, plumbing, electrical installations or other equipment for habitability.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.