Hey, it's Tax Mama from TaxMama.com. Today, Tax Mama hears from Craig in the Tax Scripts forum who asks, "Are items on a HUD one seller side lines 510 through 519 deductible by the seller as taxes paid on Schedule A or are they adjustments to the basis?" Well, Craig, Rita Lewis, an enrolled agent in Connecticut, says the seller can deduct those real estate taxes up to, but not including, the date of the sale. If they were assessments condo fees and so forth, then they're not deductible. Investment property will have a different treatment for those lines. Tax Mama adds that the homeowner can deduct the amounts on HUD one line 510 and 511 on Schedule A. Rental property owners can deduct them on Schedule E line 512. Assessments are not deductible, those are fees not taxes. You could capitalize those. The other items would probably not end up as deductions depending on what the costs are. They might be capitalized or they might be ignored. Those lines might include penalties for late taxes and so forth. Those are neither capitalized nor deducted. Now, as Rita explained, property owners can deduct taxes paid as long as they own the property. Sometimes, though, a seller will pay a buyer's share of the taxes. Those aren't deductions, those would be basis adjustments or adjustments to the sales price. Since they aren't the homeowner's taxes, remember that they can't be deducted. And remember, you can find answers to all kinds of questions about the tax handling of HUD statements and other tax issues for free at TaxMama.com.

Award-winning PDF software

Florida Hud 1 Form: What You Should Know

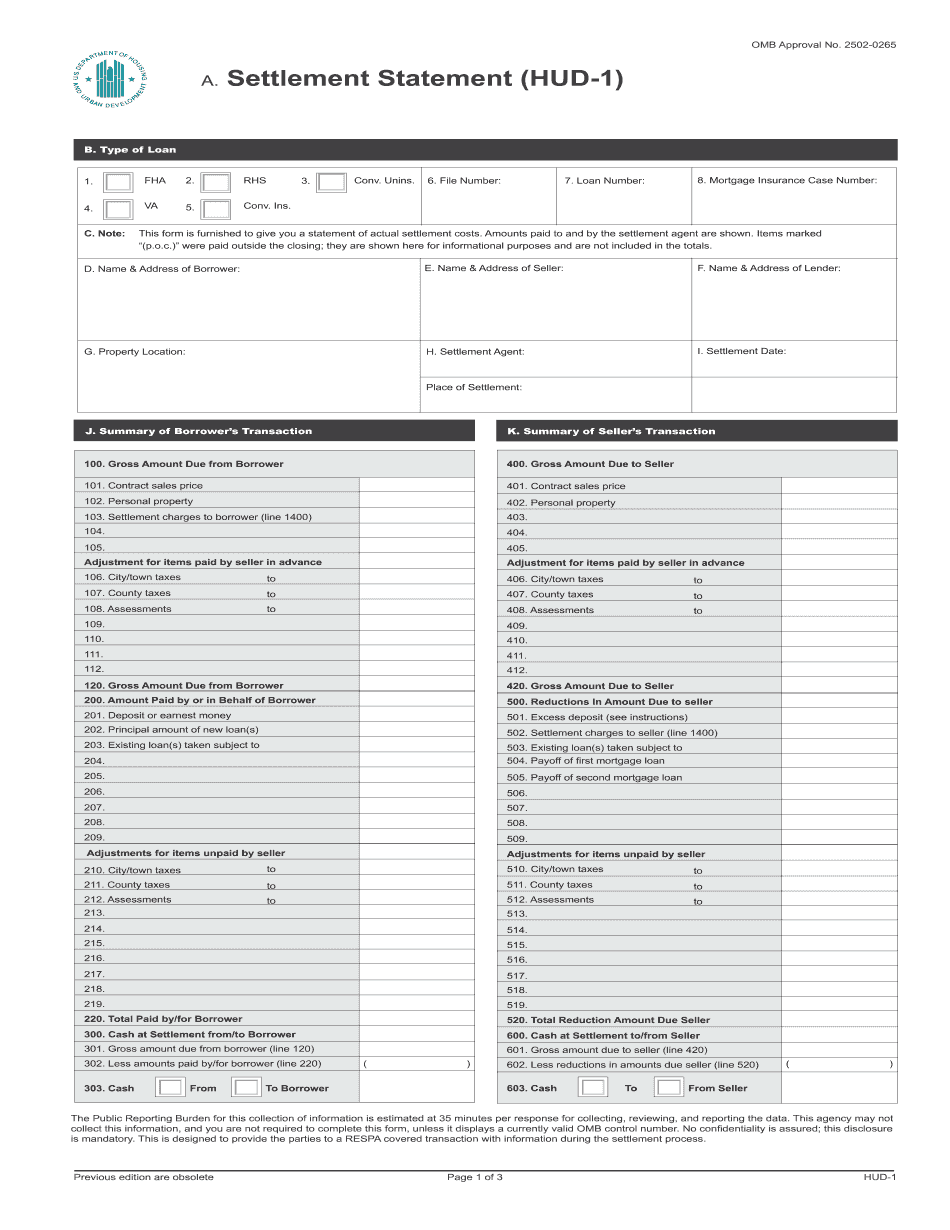

The HUD-1 Form is a standard settlement statement that is provided through the Settlement of Real Estate Closings, or the Uniform Settlements Act, at the request of the buyer and the seller to resolve a real estate settlement. . Form Description: The HUD-1 is a standard settlement statement that includes the following: Charge(s) to the buyer and the seller Charge(s) to the buyer The total amount paid by the buyer to the buyer, to the seller Charge(s) to the buyer and the seller The total amount paid by the buyer to the seller Amount the seller pays to the buyer, and the sum of the amounts paid by the buyer and the seller. If the closing company was not the actual closing seller, the charge to the seller is deducted (for purposes of this section, a seller is a person or entity that has participated in the real estate transaction as the actual seller). The amount is paid to the parties in equal monthly installments. If the closing company has any charge(s) other than these amounts that are not paid to the buyer or to the seller, the sum is paid to the parties in equal monthly installments. Payment of the balance due is made on or, if required, before the last day of the calendar month following the close of the transaction. [Florida Statute Title XVI, Section 1040] A copy of the HUD-1 is located in each closing directory listing the sale and a link to the Federal Register web page that is located in the online sales directory.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida Hud 1