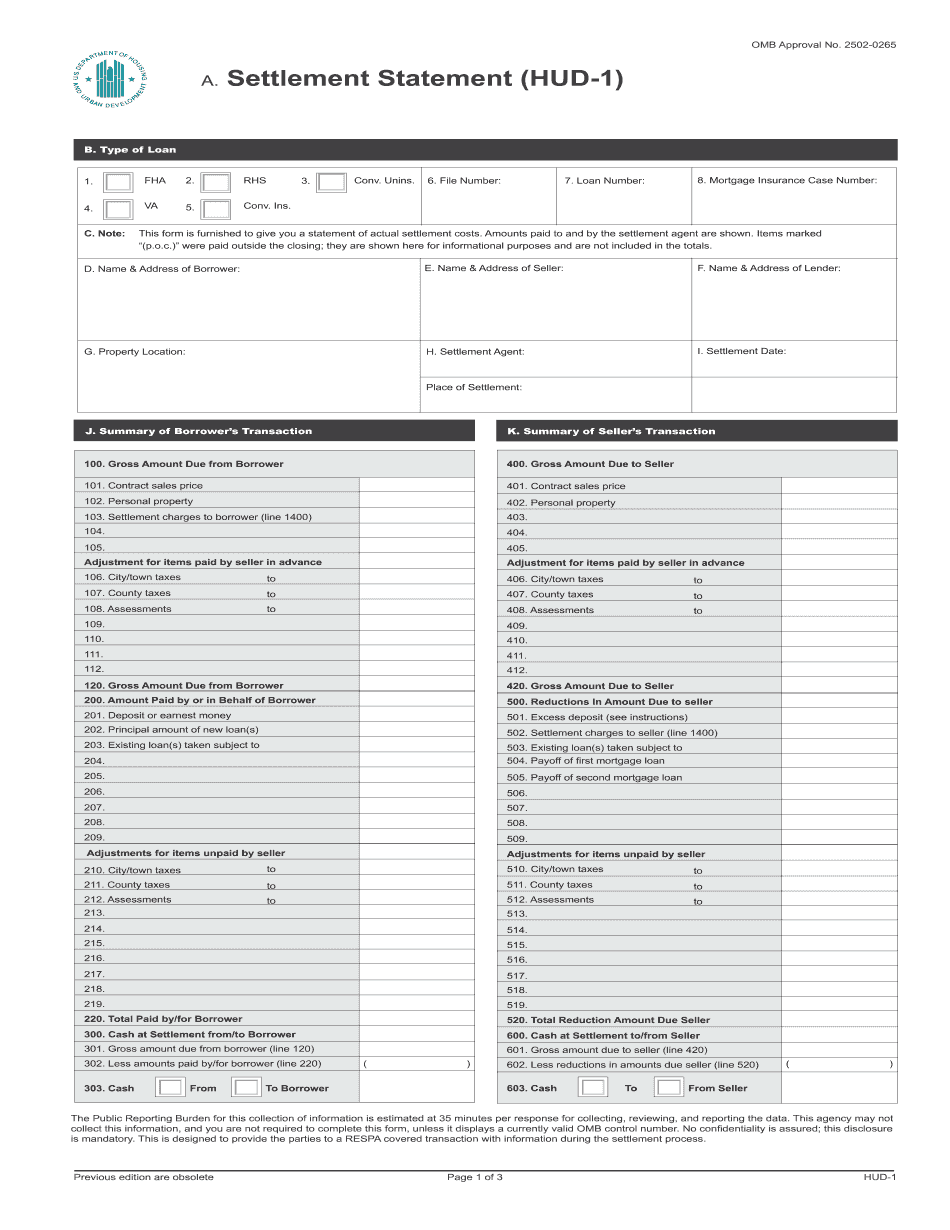

Hi, my name is Lena Gretchen Keller Williams Realty. Today, we'll be discussing how to file HUD-1 statements. A HUD-1 statement is a form that itemizes all charges imposed on a borrower and a seller in a real estate transaction. A few examples would be the purchase price, the mortgage amount, and if there's a home warranty provided. The commission for the real estate agents and all those numbers will be placed on a HUD-1 statement. This HUD-1 gets signed by the buyer and the seller, and then each party in the transaction receives one at the end of closing. The title company, the buyer, the seller, and both real estate agents will receive a HUD-1 statement. If the statements for the buyer and the seller are not the same, they will each receive their respective statements. Additionally, if there is a lender involved for the buyer, they will also receive a HUD-1 statement. If there was a mortgage on the property from the seller, they too will receive a HUD-1 statement. So, those are all the locations that the HUD-1 statement will be sent to once the transaction is closed.

Award-winning PDF software

Hud-1 explained Form: What You Should Know

The form is intended to provide accurate values of all the amounts due under the contracts of sale. 1. Summary of Borrower's Transaction This form is furnished to give you a statement of actual settlement costs. 2. Amount Due This statement shows the amount you are responsible for paying to acquire title or to terminate the loan, which must be paid at least 10 days in advance of the sale of the property. 3. Interest rate, amount, and date. A. The interest rate is the annual interest rate or the annual percentage rate. This interest rate will be listed at the beginning of this statement. Interest Rate: (annual rate/year) B. The amount due on the loan is the total amount to be charged by the bank for the loan. This amount should never be negative, except in the event that you are to borrow money from the bank to pay for the closing costs. You will not, however, be obligated to pay what is called “premium,” which includes fees that are normally paid or will be paid by the bank as a result of your borrowing the money. However, you must pay your entire mortgage amount, including a prepayment penalty. Interest Rates B. A. Interest is computed at an annualized rate of 13.0 percent (for residential mortgages) or 10.00 percent (for nonresidential mortgages). The interest rate is expressed as a monthly rate, usually equal to a percentage of the principal. A fixed-rate mortgage will have the monthly payment adjusted monthly after a set date as a function of an interest rate (sometimes called an “index”). B. Interest is payable on both the monthly and the annual basis. A fixed-rate mortgage, for instance, will pay interest at an annual rate of 13.50 percent. Interest Rate: (annual rate/year) C. If there is not a purchase price deposit, this statement should be a copy of the current statement of the buyer. J. Buyer's Signature 1. If the buyer has no purchase price deposit included, this is his or her signature. 2. If the buyer has a purchase price deposit included, it is his or her signature. S. Date The date of the settlement statement. 3. Payment Method Date The date of the final payment of the amount due for the property. I. Property Address of the property. K. Amount of Property Value This is the total cost of the property at the time the mortgage was taken out.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Hud-1 explained