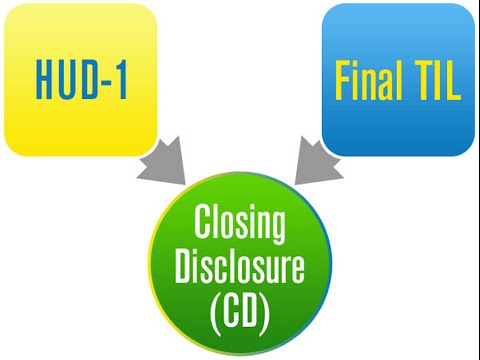

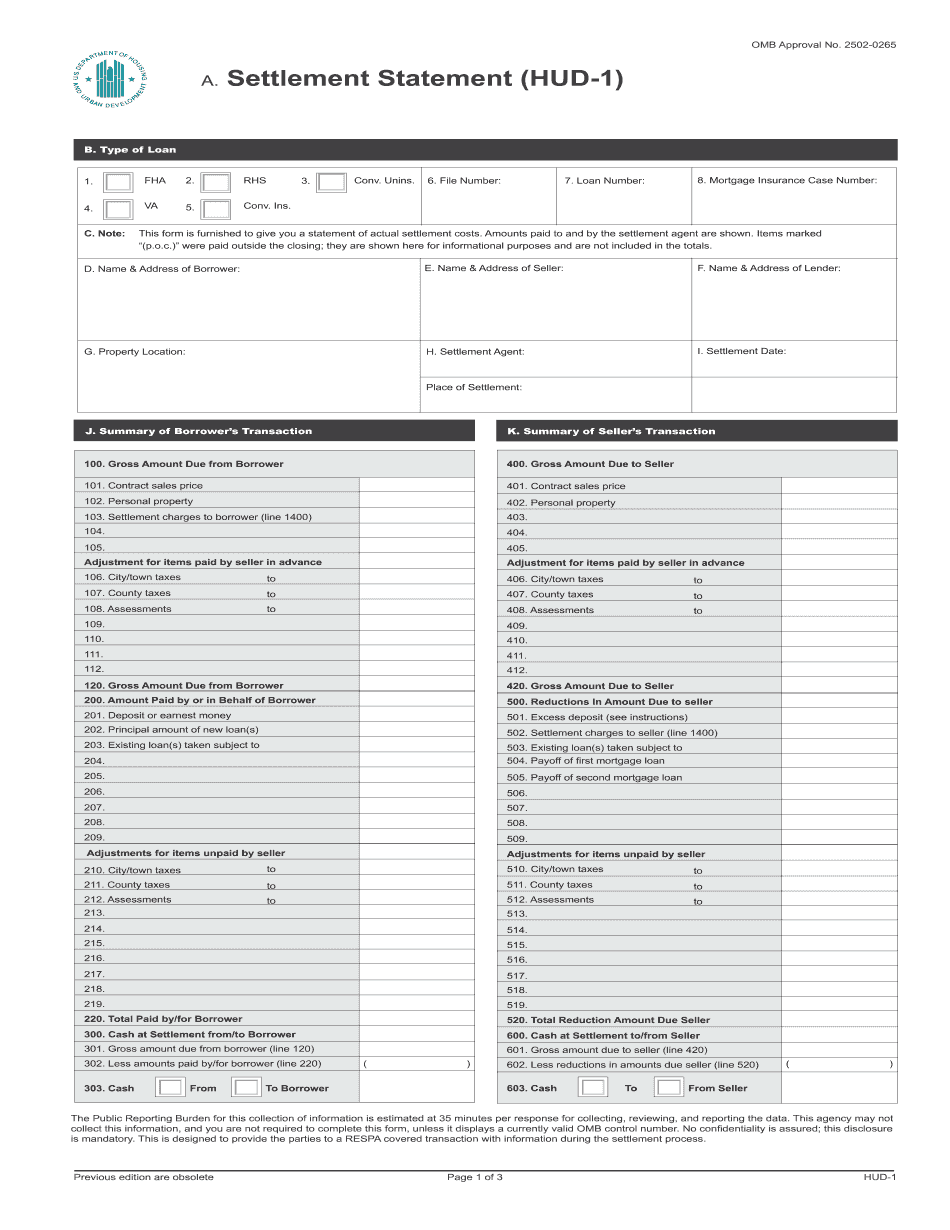

I really like the CD, the Closing Disclosure, versus the HUD. First and foremost, we're no longer referring to it as a HUD because that confuses people with HUD's housing Urban Development. So, why do you call the terms used very lightly? Yeah, yeah, I mean it goes everywhere with all sorts of stuff in the real estate business, but you know that, that to me cleans that up. Then, the CD itself is more... I don't want to... I don't know if I can say transparent, but I think it definitely does a much better job of more or less categorizing things, presenting things in a better way. The only thing that I think that's really gonna throw anybody for a loop is the TIP, which is a Total Interest Percentage. The Truth in Truth in Lending form, where it gave you the annual percentage or the total interest paid over the course alone, right? And a lot of people look at that number like, "Okay, my rate is X, I'm borrowing, let's say, two hundred thousand, but your total payments back is like, you know, double that, you know, four hundred something whatever." And the TIP, the Total Interest Percentage, is a large number that kind of, I think, is gonna throw some people for a loop just because the government is trying to say, "Hey, this is what you're gonna ultimately pay at the end of the transaction." Now, what do you know for us? The biggest thing that we're seeing with the closing documents is the government now wants the consumer to see the full cost, regardless if the seller's paying anything. So, like right now, it's traditional and it's a common thing that the seller provides title insurance, and that's typically written into the contract...

Award-winning PDF software

Hud 1 vs closing disclosure Form: What You Should Know

You fill out. Sep 20, 2024 — The form you print is a “furnished printout.” The forms need to be signed by a loan officer to release the information. You can request a signed copy, but we have no proof you are even able to do it. The Filing and Use of the HUD-1 Statement | TheLoanExecutions.com Sep 20, 2024 — The HUD-1 statements are typically filed or used by January 1st, 2022. After that date, you have until Dec 31st 2024 to print and use the form. However, if you have filed after that date, the HUD-1 will be available for you to file electronically from December 10th. You will be sent an form on or before December 10th and the form will become available for use between March 1st and the first day of the following year. This may give you an advantage if you wish to file your closing statement by May 1st 2017, just a few days after the Form 8300 is no longer effective. Read more from the HUD-1 Summary. How to Use the HUD-1 Statement | FMCSA Mortgage Services How to Fill Out Your HUD-1 | FM SCA Mortgage Services How to File a HUD-1 Statement | ADSL Mortgage Services Hudson Housing Loans — Summary of Terms | HomeAdvisor Hudson Housing Bonds How to buy a New Hudson — Federal Home Loan Mortgage Corp. (FILM) Is The Hudson Housing Bond a Debt Offering? This question must have you scratching your head and asking yourself, “Hah! Hah! A debt offering is the best way to be involved in an investment, and the Hudson Housing Bond is no exception! But is it really a debt offering? Are you in an investment in a residential property? The answer is YES and NO! While the mortgage is structured as a direct offering to the public, the Hudson Housing Bond may be the most liquid option of all the mortgage and investment products listed in this document. There's a lot to explain, and you can find everything you've ever wanted to know about The Hudson Housing Bonds through these pages. You'll also learn about the key differentiators between the bonds and loans and be sure to read about how you can get involved with the bond through an FILM Investor Assistance Program.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Hud 1 vs closing disclosure