Here is the corrected version: Hi, this is Evan Hutcheson, CPA. I am going to explain the correct way to input a property sale into QuickBooks. I am using QuickBooks desktop, but you can use any software. This process is not specific to QuickBooks; I am simply demonstrating how to make a journal entry in your bookkeeping software for a property sale. This tutorial is applicable for investment properties or properties that you are flipping. It is not meant for personal residences. In this journal entry, we need to show the sale price, the costs, the loan closing, and the final cash coming in. We can consolidate all this information into one journal entry. The key thing to remember about a journal entry is that the debits must equal the credits. This is the fundamental principle of accounting, which follows a two-entry system. I will explain how this works for this particular entry. First, in QuickBooks, go to the Company menu and select "Make General Journal Entry". A pop-up will appear where you can input the correct date (June 20th, 2016) and the entry number of your choice. Then, you can start entering the journal entry details. The first entry will be the sell price of the property. As the seller, we are only concerned with the left-hand side of the entry. Select the appropriate account name for recording income. In this case, it might be "Construction Income". Since we are creating income, we will credit the amount of $659,900. You can add a memo if desired, but it is not mandatory. However, it is important to come up with a name for the property or job that will allow you to track income and expenses related to it. This will be useful when running profit and loss reports or any other analysis. Please note that...

Award-winning PDF software

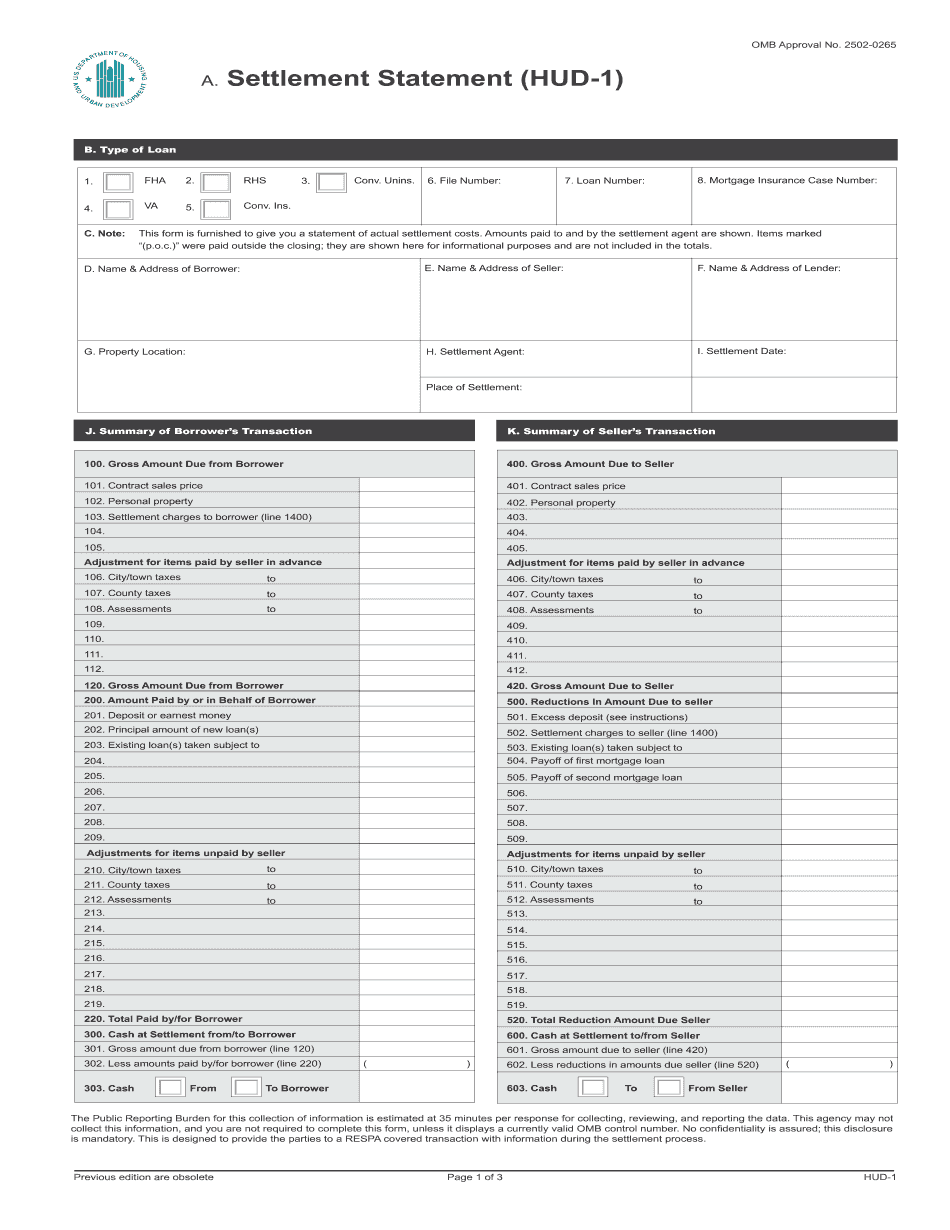

Hud 1 cash transaction Form: What You Should Know

HUD-1A, Settlement Statement. This settlement statement is an annual form that the homeowner or non-resident accepts as a requirement for sale of the property during the term of the agreement. It is provided upon completion of the mortgage transaction and upon the closing of the transaction by the lender. For example, a cash sale where the homeowner sells the property, not a mortgage, is usually a HUD-1A. There may be a difference of opinion on whether a cash sale in this process may have the same settlement statement. If there was a conflict between the title loan documentation and the settlement statement, the HUD-1A represents the final agreement. But again, the terms of the title loan documentation were the final agreement for the sale. Some examples of HUD-1s: (please note all of this information was obtained from the Federal Register) • Mortgage (including refinance) with title loan (Fannie Mae, Freddie Mac, etc.). • Cash sale of a home (including HUD-insured loans or FHA-insured mortgages) • Home equity lines of credit. • Home improvement loan with low down payment. • Sale of home without a mortgage (includes a foreclosing or foreclosing under foreclosure, title modification or waiver process). • Purchase by a non-resident of a federal home loan. • Loan modification with low down payment, which is the case when the borrower made the purchase and the modification was made before the closing. • Sale of a non-U.S. Citizen. • Sale of a U.S. Citizen non-resident. • Home Purchase with HUD-1 and FHA-insured mortgages. • Title loan that is non-U.S. Citizen. In all cases, the settlement statement states the amount paid to the seller as well as the amount actually paid to the seller by the bank. The statement states the date the sale was finalized and, more importantly, that the seller accepted the terms and conditions of the transaction. This form is given to the party who sold the property and/or to the agent of the seller as required by HUD. HUD-271H — This form is used for the purchase or sale of property that are part of a home purchase or sale plan that meet the requirements for the title loan program. In this case it is also necessary to use the HUD-272 form prior to closing the sale. (please note this is HUD-271 form) Purchaser Who purchases the home? The purchaser is the owner of the property. No.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Hud 1 Form cash transaction