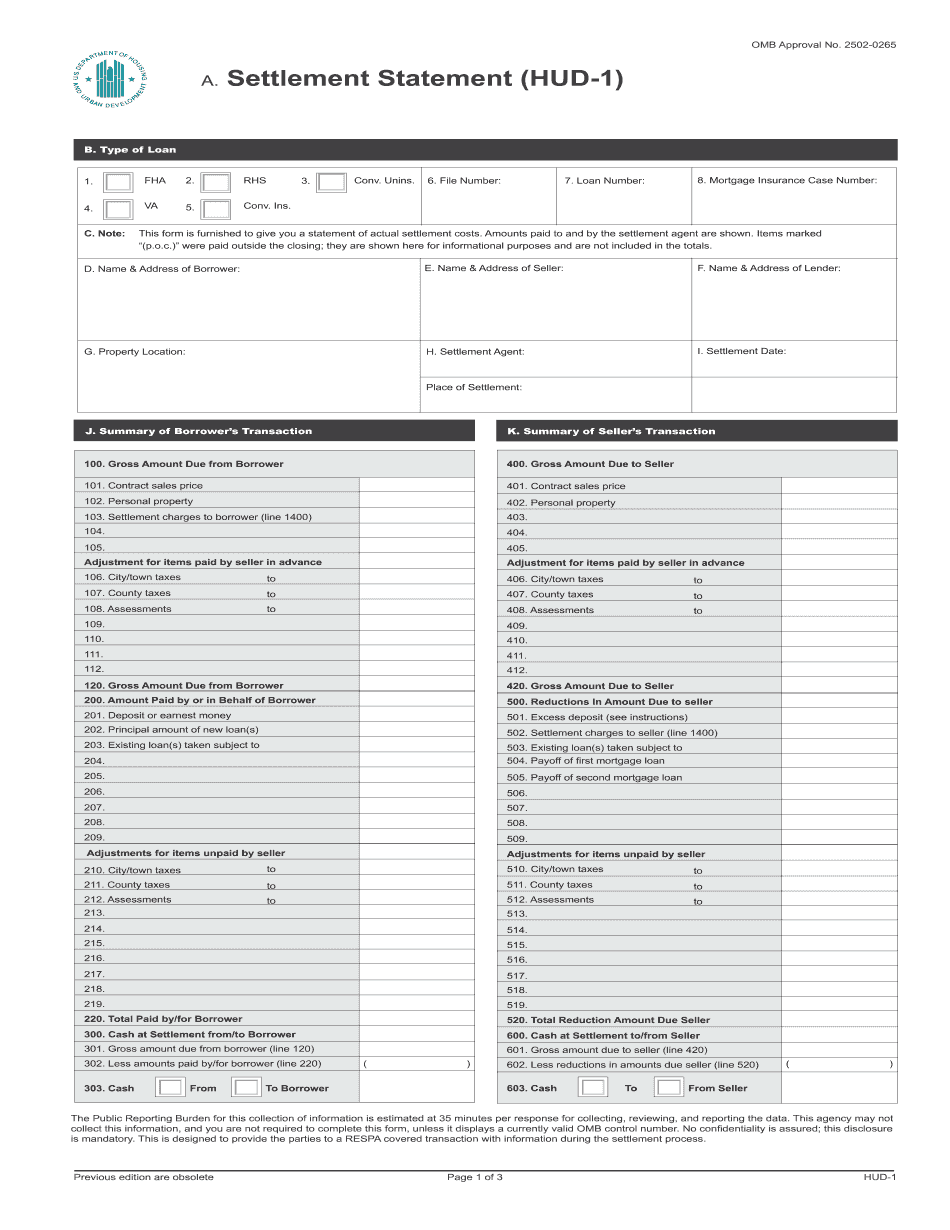

Music, hi. I'm Dave Dang. This is my two-minute fix. When I started in the business, people asked me all the time, "Who was your mentor?" There weren't any mentors in 1975. There was nobody that I could look at and learn from. Certainly, I couldn't watch a webinar at three o'clock in the morning and become a billionaire in three days. So, there was nobody like that around. So, I wanted to do real estate. I didn't like it, and I'll tell you why. It was just very difficult when we got properties and went to sell them. Those buyers are picky. Anyway, I was used to something altogether different. I was in the stock market and I could sell stuff. For you guys in the stock market, in those days, it took no more than about 15 to 45 minutes to sell a stock and get an answer back. Today, it takes 15 nanoseconds to do it. So, one of the things I also did not like was going to closing and having to review the HUD statement. It was like a mystery to me. You know, I'm the buyer and the seller, and what are all these fees? And say, "Hey, those are really, really important." When I started to look at them and analyze them, people believe it or not, I'm a chemical engineer by trade. I realized there's power in understanding those numbers. First of all, being able to save money when you get to the closing table. Figuring out who did what, who was charged for what. Just because you're the buyer doesn't mean you have to pay for certain things. So, understanding the HUD is critically, critically important. So, the two-minute tip here is just simply understanding a HUD. Now, in the Dodd-Frank...

Award-winning PDF software

Hud statement for taxes Form: What You Should Know

Net Income Not Received. Deduction not to be reported separately; 903. Income. Includes gross income, net income, and income from sources other than sources subject to self-employment tax ; 904. Gross Income. Includes wages and salaries and any other income from self-employment; 905. Gross Income from Self-Employment. Includes self-employment income from wages or salary and self-employment income to the extent not included in gross income from wages and salaries. 906. Net Income. Amount from all sources and apportionment; 907. Expenses. Included is those amounts paid as a result of transactions involving the sale of real Prorated interest, expenses, and gross income can be found on line 14 of Form 1098 (pay stubs), 1120. Additional Charges. Deductible as itemized deduction — typically included in year-end interest statement (Form 1098) ; 1139. Mortgage Interest. Deductible only if the mortgage was obtained by you ; 1140. Principal Property Tax. Net of homestead exemption — usually not deductible ; 2. FICA deductions. Deducts employer withholding. Income. Gross income; 3. Social Security: What's on Line 10? 1. Social Security and Medicare — Social Security and Medicare are mandatory for every worker and non-working dependent. You can't have more than one tax form for social security and Medicare, and you still have to complete Schedule A. You must either have a valid Social Security number, or a Social Security card provided by your employer. (If you don't have one, you must enroll in the Social Security program before you start collecting SS. See Social Security, for more information.) 2. Other. Income from sources other than social security (other than income from non-working dependent parents), and deductions under other laws, including the alternative minimum tax. For details, see Instructions for Schedule A. See also the Instructions for Form 1040. 3. Other. Includes: interest on federal and state-backed home mortgages — including the interest you pay on your home loans and any interest you pay on other loans as a result of refinancing or extending your mortgage, and loan interest; labor-related employer social security (FICA) contributions; federal housing-sector tax subsidies — including Federal Housing Administration loans; and state- and local-sponsored housing-assistance programs — 4. What's on line 12 of “Mortgage Statement?” 1.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Hud statement for taxes