Hey guys, this is Jennifer with vivo Realty. We have a special encore presentation of free money to buy a house. There is an awesome program that offers fifteen thousand dollars to help you buy your home. This money can be used for your down payment and closing costs. The best part about this program is that you do not have to pay any of this money back if you stay in the home for five years. However, with some of our other first-time homebuyer and assistance programs, you do eventually have to repay the money when you sell the home, usually in ten or fifteen years. So, how do you qualify for this money? If you are a first-time homebuyer or if you have not owned a home in the last three years, you are eligible. This means that even if you were once a homeowner, you can still apply and get back into the market. Now, what can you do to get this money? There are three steps you need to follow. First, take a HUD-approved first-time homebuyer class. If you need information on that class, please reach out to us, and we will provide you with a list of providers. Once you complete the class, you will receive a certificate that is valid for two years and can be used for this program. The second step is to work with an approved lender. Not all lenders participate in this program, so make sure you find one that is approved by the state of Florida. These lenders have passed certain certifications and taken specific classes. By working with an approved lender, you can find out if you are eligible for the program and what steps you need to take to get approved. Finally, the third step is to find a great realtor...

Award-winning PDF software

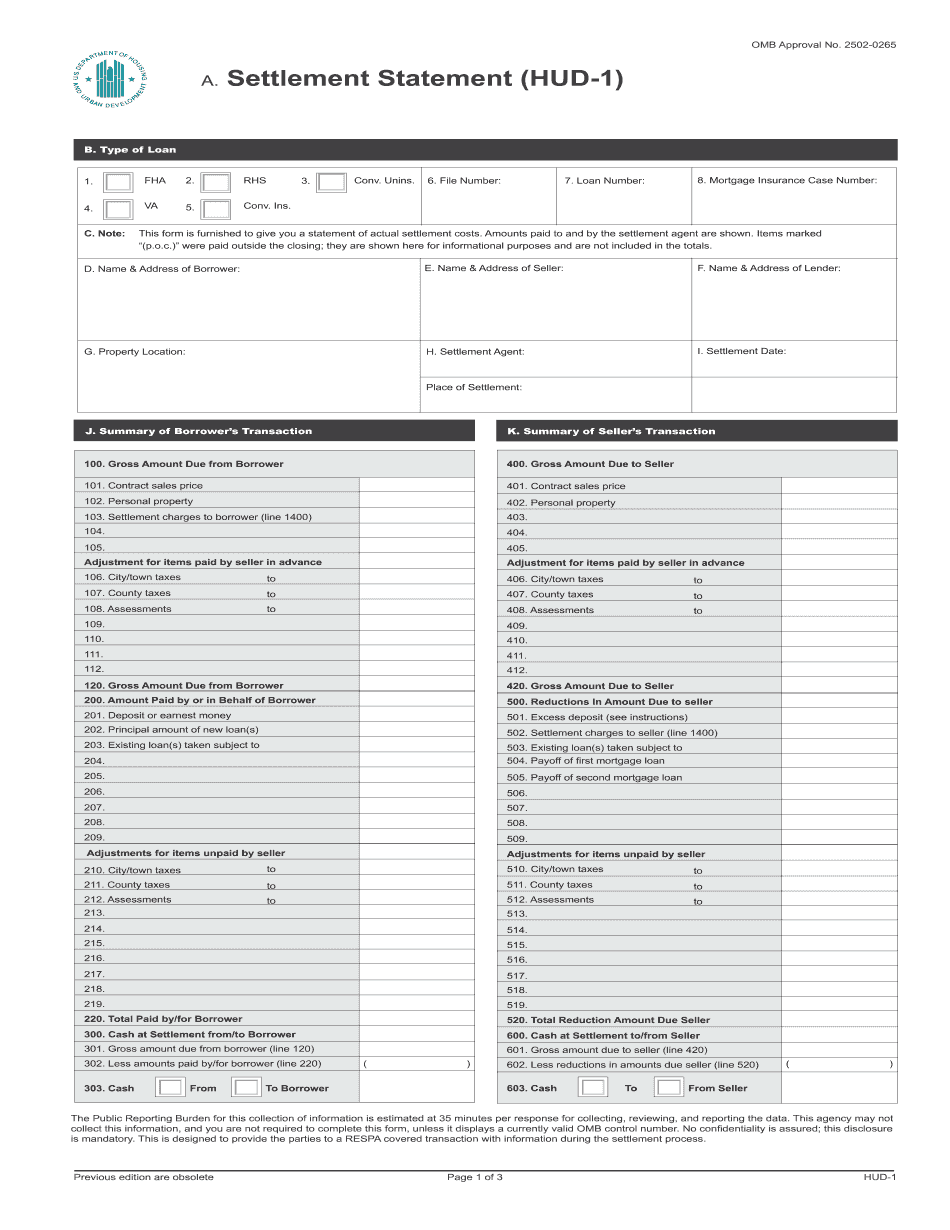

Florida hud-1 Form: What You Should Know

HUD-1A, Settlement Statement — Optional Form for Transactions without Sellers Jun 1, 2024 — The final revision of the HUD-1 form now permits only sellers to itemize the cost of the purchase price and mortgage interest, or both. There is no longer an item requirement for any other cost such as escrow or taxes. What is a HUD-1 Settlement Statement? Aug 1, 2020 — The final revision of the HUD-1 form now permits transactions to include only buyers and sellers, not third parties of any kind. What is a HUD-1 Settlement Statement? July 2, 2024 — The final revision of the HUD-1 form now requires the seller to list all costs and charges. There are no costs in the settlement that are not itemized by the seller. What is a HUD-1 Settlement Statement? Dec 2024 — On December 27, 2016, HUD amended the HUD-1 form to exclude the costs of the purchase price in settlement, HUD-1- Florida -- Proposed Rule 1.11b1 : Inclusion of Purchase Price Cost ; HUD-1- Florida — Proposed Rule 1.11b1-1 : Inclusion of Mortgage Interest. What is a HUD-1 Settlement Statement? Sep 20, 2024 — On June 21, 2016, HUD amended the HUD-1 form to remove the requirement of listing any additional costs. Only purchases or sales or both must be itemized. What is a HUD-1 Settlement Statement? Sep 19, 2024 —On July 10, 2014, HUD amended its final rules and regulations pertaining to the use of the HUD-1 form for mortgages, a change that removed the requirement of listing any additional costs on this form and introduced an optional form that could be used to report and reconcile payments in transactions without sellers. The updated form eliminated the seller obligation to include the seller's cost of purchase. Under this change, however, the new form does not permit either buyer or seller to request that the costs of purchase, other than taxes and insurance, be excluded from the sale of the property by the seller, and it only permits a final settlement offer to include a fair and reasonable amount of costs.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida hud-1