Everybody, let's discuss the necessary components of a short sale package. This package is crucial for real estate investors who are representing distressed sellers and seeking to avoid foreclosure. To begin with, the authorization to release information is required. This document allows the real estate agent to advocate for the seller and negotiate on their behalf with the lender. Additionally, the seller's hardship letter is a crucial element. In this letter, the seller explains their current financial situation and outlines why a short sale is the best option for them. The executed listing agreement is another essential part of the package. It reveals how long the property has been on the market and provides details about the brokerages involved and the commissions paid. This information helps the lender determine the viability of the short sale. An executed purchase contract, similar to any other purchase agreement, demonstrates that both the buyer and seller have agreed on the terms of the sale. Alongside these documents, a pre-approval letter is required to prove that the buyer's finances are in order and they are prepared to proceed with the purchase. A copy of the earnest money, which serves as a deposit, further assures the lender of the buyer's seriousness and commitment. Financial information is a critical component of the package. Many banks provide PDF forms that request a breakdown of assets, liabilities, monthly expenses, and employment details. This information helps lenders assess the buyer's financial situation and evaluate their eligibility for a loan. To summarize, a short sale package must include the authorization to release information, a seller's hardship letter, an executed listing agreement, an executed purchase contract, a pre-approval letter, a copy of the earnest money, and detailed financial information.

Award-winning PDF software

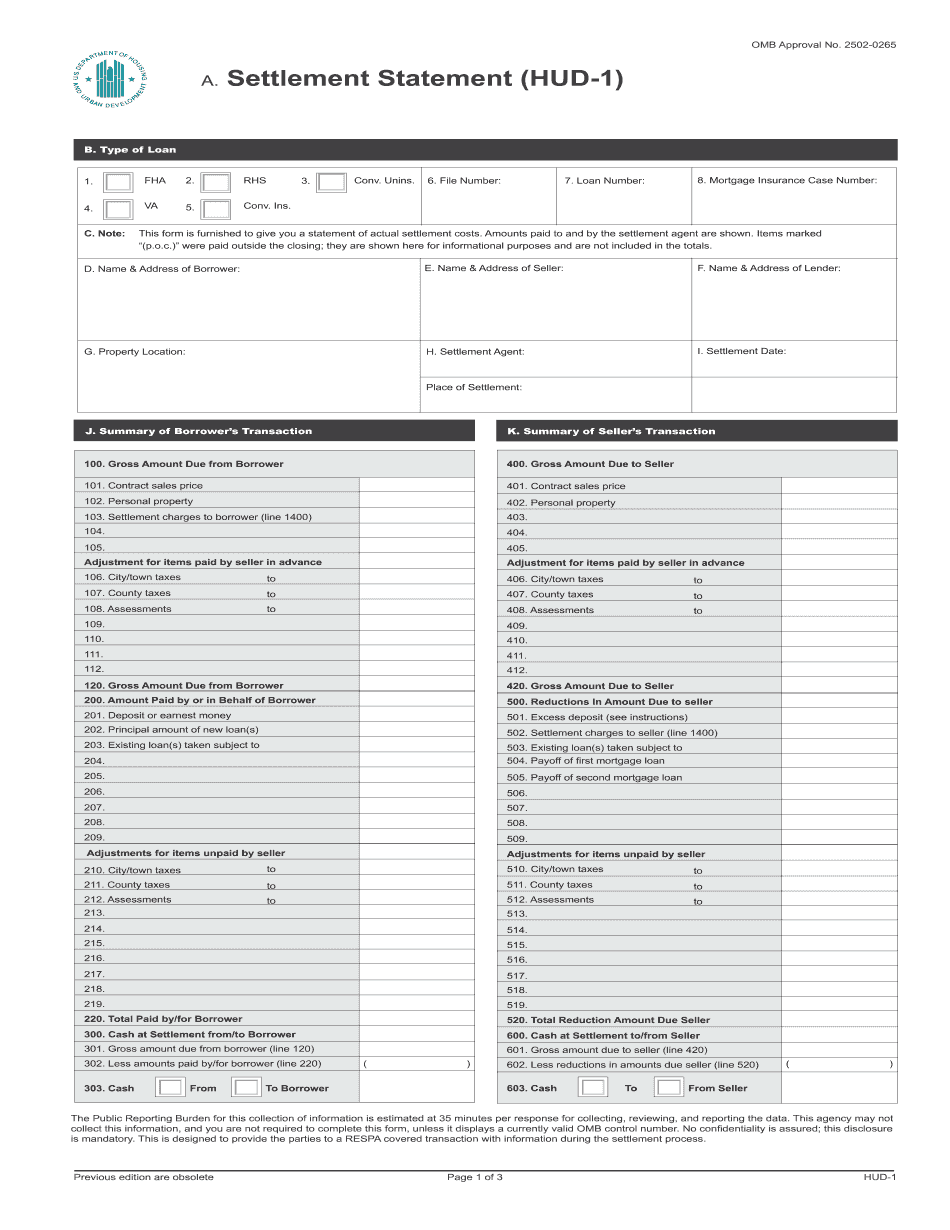

Preliminary Hud 1 Short Sale Form: What You Should Know

Appendix A to Part 1024 — Instructions for Completing HUD-1 How to Prepare the HUD-1 Settlement Statement Form and the HUD-1A Settlement Statement Instructions for Line 101. A Settlement Statement is part of the settlement and is required to inform the Borrower and the Lender of the following: The amount of any settlement costs imposed by the Lender and by the Settlement Agent for the transaction, which shall not exceed the sum of the actual charges and credits to the Borrower and Seller How much of the total settlement costs should be included in the settlement statement. Line 105 — Payment for Title Insurance, Line 109 — Mortgage Insurance Premiums, Line 115 — FHA Loan Interest Rates, and any other charges imposed by the Lender or the Settlement Agent for the transaction or for any related loan (including, without limitation, the cost of title insurance and mortgage insurance premiums). How much of the total settlement costs should be included in the HUD-1 Settlement Statement. Instructions for Line 116 — Payment of the Lender's costs incurred in preparing and completing the HUD-1 Settlement Statement. Instructions for Line 117 — Payment of the Lender's costs incurred in preparing and completing the HUD-1A Settlement Statement. This will help the Borrower to know the real costs for which the Lender has been paid. Instructions for Line 126 — Payment of the settlement costs imposed upon the Borrower by the Lender and for settlement charges imposed by the Settlement Agent. Instructions for Line 130 — Payment for the Costs of the Lender's Collection Account and for FHA Loan Interest Rates (after the costs have been deducted, the total settlement costs shall be the sum of the costs of the Lender and Settlement Agents' collection accounts and costs for FHA Loan Interest Rates.) Instructions for Line 139 — Payment of the costs to the Lender and for Settlement Charges imposed upon the Borrower by the Settlement Agent. This will help the Borrower to know the real costs of which the Lender has been paid. Instructions for Line 140 — Payment of the settlement costs imposed upon the Borrower by the Lender and for settlement charges imposed by the Settlement Agent. This will help the buyer to know the real costs for which the Lender has been paid. How much of the total settlement costs should be included in the HUD-1 Settlement Statement.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Preliminary Hud 1 Short Sale