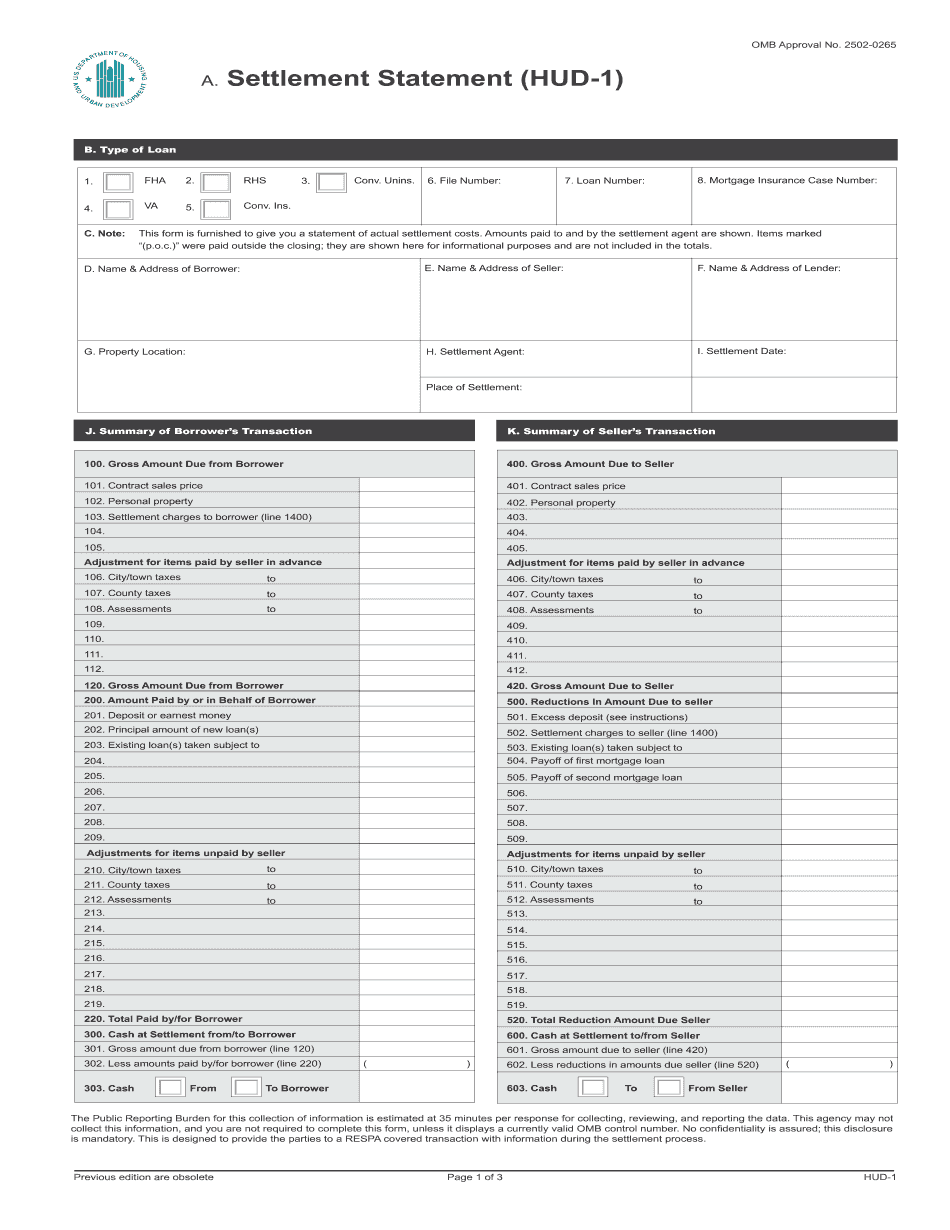

This fall, how you finance real estate is going to change, and it's not clear whether real estate industry professionals like real estate agents, brokers, lenders, and title officers are actually ready. I'm Elise Glink, and here's today's real estate minute. I want everybody who's watching this to get ready for TILA RESPA or Tyler RESPA, depending on how you pronounce it, which may be the acronym to end all acronyms in real estate. It stands for the Truth-in-Lending Act/Real Estate Settlement Procedures Act integrated mortgage disclosures. You may also see the acronym TRID refer to this as well. Okay, so here's the good news: it's not going to affect you yet. This past week, the government delayed the implementation of the new Tyler RESPA change until the first day of October. The bad news for many is that once the new law takes effect, the changes to the process of getting a mortgage will be significant, especially for those real estate professionals who've been working in the residential side of the business for quite some time. The first major changes in the paperwork: the existing Truth in Lending statement is getting merged somewhat with the existing HUD-1 settlement statement. And what does this mean for most home buyers or mortgage borrowers? Closing agents, title companies, and closing attorneys will now deliver something called a closing disclosure statement to the borrower. The closing disclosure statement is a five-page form that combines many aspects of the Truth in Lending form and the old HUD-1 settlement statement, also affectionately known as the RESPA statement. Now, in addition to the closing disclosure statement that is given to the borrower and not to the seller, the buyer and the seller will then sign a settlement statement. The new settlement statement has a very different look...

Award-winning PDF software

Respa Settlement Statement Form: What You Should Know

C.2.6.9.2 — Lender's Settlement Statement (Forms & documents) — Optional C.3.9.2.3 — Closing Statement (Forms & documents) C.3.9.2.7 — Property Loan Disclosure Statement (Forms & documents) How to Use This Guide The first step for understanding the mortgage lender's settlement terms is to determine a minimum amount that is fair to both the buyer and seller. For example, let's say you and your friend decide to enter into a contract to sell a house that is for 300,000. As per the contract, you would be obligated to pay 60,000 up-front and then get 25,000 from the seller at closing. The first payment to be payable by the buyer would be 20,000, as per the contract. The amount to be collected on the seller's behalf would be 15,000. What is a fair market or fair share payment? The amount or amount paid by both the buyer and seller in the first round of settlement is what is called a fair share payment. A fair share amount is the amount that covers the amount of time that the seller has been collecting on the loan. For an example, an applicant is planning to buy a property that is for 300,000 for ten years (or one month). The applicant will be on a month-to-month basis paying for the property (loaning money to the seller) and receiving 10% of sales at the end of the contract period (the actual closing). Therefore, according to the lender's settlement rules, the seller will receive 50,000 of the 300,000. (See Appendix M, Loan Details in the “Sample Loan Package.”) For more information on “fair market,” please visit the Fair Market Payment Guide (MPG). This is a guide on the MPG, written by the Mortgage Bankers Association (MBA), for members of the MBA. If both parties agree to the price of the house as the fair market price, then the amount paid by the buyer at closing is equal to the fair market price. For example, let's say that you and your friend have purchased a house for 300,000. On the first day of the contract, the contract price per square foot is 260, plus 60,000 for the down payment.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-1, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Respa settlement statement